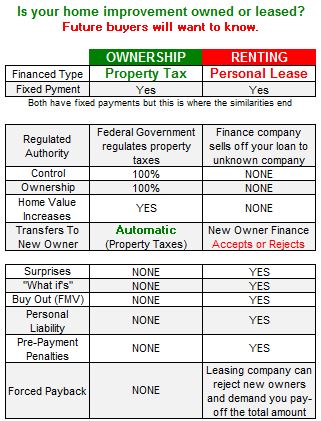

Loan vs Lease Comparison

Why rent your home improvements

When you can own and $ave

The decision about how to finance your Green Power System depends on your particular financial goals.

Renting: Personal Lease Financing

Buyout: Fair Market Value (FMV) Buyout is required at the end of the term. Can be 20% or more

Transfer: New Owner credit checks. Lease holder determines their best financial position

Savings: The finance company gets all available financial incentives with many of them upfront

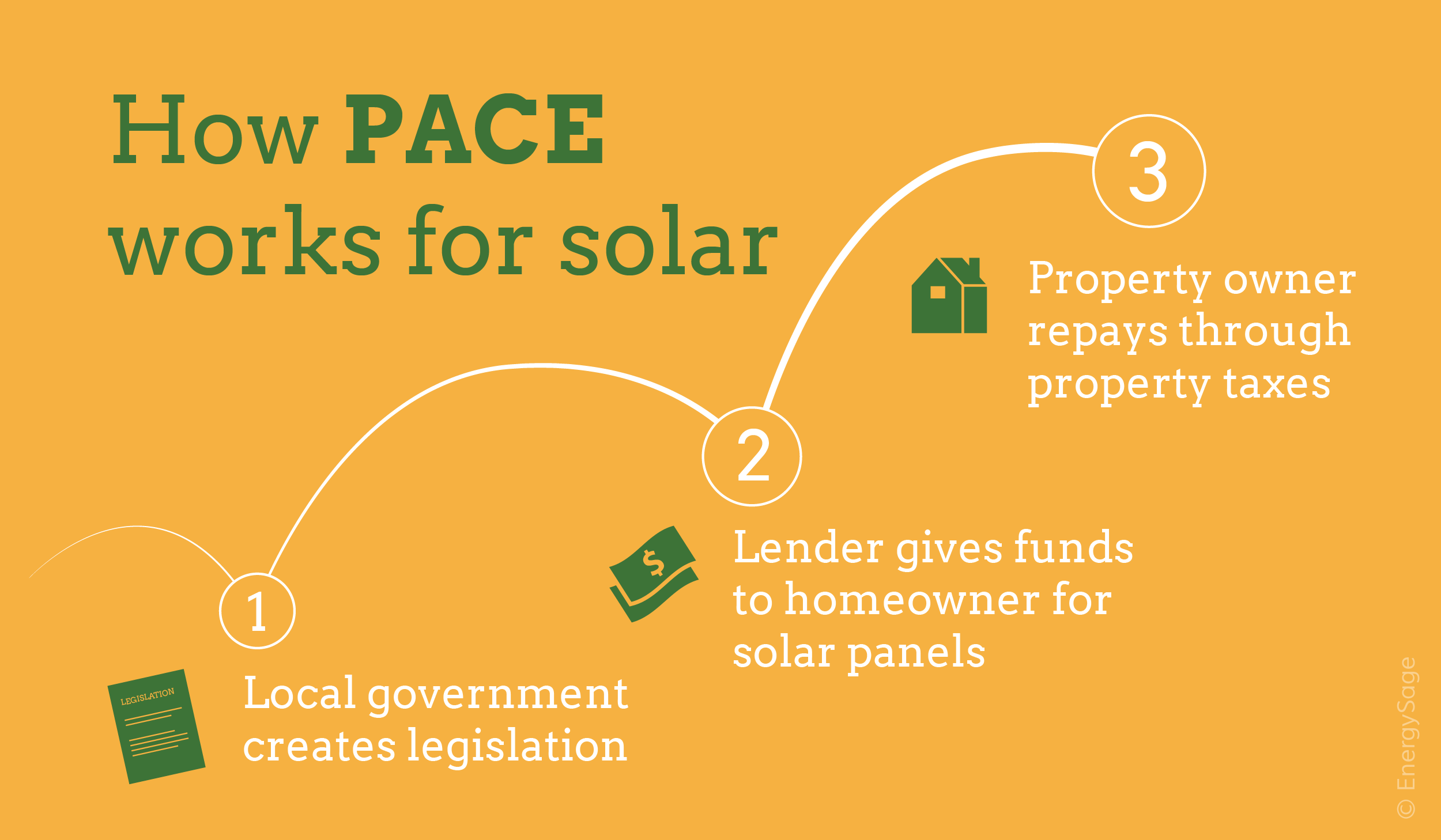

Ownership: Property Tax Loan

Buyout: At the end of your loan term there are no further payments or costs

Transfer: Property taxes transfer to the new owner per local existing tax laws

Savings: You receive available financial incentives

The two most common forms of home improvement financing are: 1) Property Tax Loan (Property Assessed Clean Energy PACE); and 2) Personal Lease Financing (Home Improvement Lease Financing).

The main practical distinction between buying with a loan and renting with a lease is in ownership. If you buy your home improvements, you own the system, either outright (if purchasing with cash) or after repaying your property taxes. If you lease the system, a third party owns the solar panel system. This distinction impacts the cost, maintenance, terms, financial offsets, and savings/returns on investment of your home improvement.

With a Personal Lease Financing … who owns your original lease after several years have gone by? IT IS likely your original personal lease will have been sold one or more times to an outside investor and/or foreign finance company. You have no guarantee that the original company you financed with will be the one you deal with later on when you go to sell your property.

- Will this ‘new’ company even be kind, caring, or helpful?

- Will you only be about ‘their’ bottom line?

- Will they be punitive or predatory in their own special interest?

- Will they or their call center team even be US based?

Personal Leasing Myths

NOT ZERO DOWN: A personal lease is not zero down because the leasing company is taking all of the upfront instant rebates and tax credits.

LIABILITY: A personal lease shows up on your credit check because you personally are liable … compared to property tax financing where the financed amount won’t appear on credit report

NO TAX DEDUCTIONS: IRS rules do not allow you to write off your these payments

Why take such an necessary risk … when Property Tax Loan financing insures that you have none of these hassles if you sell or move. You personally don’t take out the loan. Payments are made each year by adding the loan amount to your property taxes

Why choose a Property Tax Loan

- 100% financing with no out-of-pocket costs

- Fast in-home approvals

- Borrow up to 15% of property value

- Flexible repayment terms: 5, 10, 15, 20, 25 or 30 years

- Balance transfer to new owner upon sale

- No prepayment penalty

- Financed amount won’t appear on credit report

Quick and easy process

- GPS will help you through the process every step of the way.

- Apply online or by phone at 855-202-1976. Approvals can happen in minutes!

- Sign financing documents electronically. No need to go to the bank.

- GPS will install your energy or water efficiency improvements.

- Repay the financed amount on your property taxes. No separate bill to remember!